Embedded investing refers to the process of incorporating investment functionality into products or services that are not primarily focused on financial activities. This implies that individuals have the opportunity to allocate their funds towards stocks, bonds, or alternative assets without the necessity of engaging with a conventional brokerage institution. Alternatively, individuals have the option to perform all necessary tasks within the existing application or platform they are utilizing.

There are several factors contributing to the growing popularity of embedded investing. Firstly, it can be argued that the enhanced convenience for users is a significant advantage. Users do not need to alternate between various applications or websites in order to effectively handle their financial matters. Additionally, it is more cost-effective. Embedded investment platforms generally tend to impose lesser fees in comparison to conventional brokerage firms. Furthermore, it possesses a higher degree of accessibility. Individuals of varying financial backgrounds can utilize an integrated investment platform, irrespective of their possession of a smartphone. Elon Musk has also laid out his vision of turning X into an embedded finance company.

Embedded Investing Examples

Several companies are currently providing embedded investment solutions. Several prominent instances can be identified, including:

Robinhood

Robinhood is a widely utilized mobile application for stock trading, enabling users to engage in the buying and selling of stocks without incurring any commission fees.

Acorns

Acorns is a mobile application that facilitates the investment of spare change by rounding up transactions to the nearest dollar and allocating the accumulated funds into investment portfolios.

Stash

Stash is a mobile application that facilitates investment in stocks, bonds, and exchange-traded funds (ETFs) by enabling users to allocate modest sums of money.

PayPal

PayPal has recently made an announcement regarding its decision to enable users to engage in cryptocurrency investments via its platform.

Venmo

Venmo intends to introduce integrated investment functionalities in the foreseeable future.

Embedded Investing’s Future

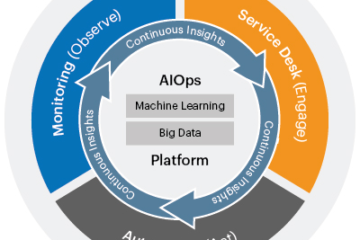

The nascent stage of embedded investing is now underway. With the increasing adoption of modern technology, it is anticipated that investing money through everyday apps and platforms would become a commonplace practice for individuals. Additionally, several startups are launching end-to-end embedded investment solutions, making it easy for companies to integrate investing into their platforms. Search volume for “embedded finance” has grown by 966% over the past five years.

Several reasons are contributing to the expansion of embedded investing. The proliferation of mobile banking and payment services has facilitated the seamless management of individuals’ financial affairs while on the move. Furthermore, the growing prominence of financial technology (fintech) firms is generating novel prospects for embedded investing. Furthermore, the increasing need for easily accessible and cost-effective financial services has become embedded investment a more appealing choice for individuals.

The Influence of Embedded Investing

The proliferation of embedded investment is exerting a substantial influence on the financial services sector. Embedded investment platforms are posing a growing challenge to traditional brokerage firms, as they are capable of providing a more convenient user experience and reduced fees. Consequently, numerous conventional brokerage organizations are compelled to engage in innovation or face the possibility of becoming surpassed. Some VCs describe embedded finance as essentially “making every company a fintech company”. Embedded insurance and embedded lending are examples of trending embedded finance tools.

The phenomenon of embedded investing has also been observed to exert influence on individuals’ investment practices. Historically, individuals commonly allocated their funds by means of a conventional brokerage institution, necessitating collaboration with a financial consultant to select investments and oversee their portfolio. Nevertheless, the advent of embedded investing has enabled individuals to actively allocate their funds through the applications and platforms they often utilize. This facilitates the initiation of investment activities and the regular monitoring and control of investment portfolios for individuals.

Conclusion

The phenomenon of embedded investment is currently experiencing notable growth and exerting a substantial influence on the financial services sector. The advancement of technology has facilitated the process of financial investment and management, enabling individuals to more conveniently allocate their funds and maintain regular oversight of their monetary affairs. As technological advancements persist, it is highly probable that its widespread adoption will further increase in the future.

Here are some more ideas on embedded investing’s future:

- It is anticipated that the practice of embedded investment will have a sustained increase in its level of popularity in the foreseeable future. This phenomenon can be attributed to the provision of several benefits in comparison to conventional investment methods, including enhanced convenience, cost-effectiveness, and increased accessibility.

- I am of the opinion that embedded investing will exert a substantial influence on the financial services sector. In light of the current circumstances, conventional brokerage businesses must undertake necessary adaptations in order to remain relevant, as failure to do so may result in being surpassed by competitors.

- I am eager to observe the future trajectory of embedded investing. I believe that this technology have the capacity to fundamentally transform the manner in which individuals allocate their financial resources.